10 Budgeting Tips for Freelancers with Irregular Income

scale.jobs

August 28, 2025

Freelancing comes with freedom, but irregular income can make managing money tricky. Here’s how you can create financial stability despite fluctuating earnings:

- Find your average income: Calculate your monthly average over 6-12 months to plan better.

- Organize expenses: Split them into fixed (e.g., rent) and variable (e.g., dining out) for better control.

- Save for emergencies: Aim for 6-12 months of essential expenses as a safety net.

- Plan for taxes: Set aside 25-30% of your income in a separate account.

- Use dual budgets: Create one for lean months and another for high-income periods.

- Track finances weekly: Regularly monitor income and spending to stay on top of your budget.

- Diversify income: Explore multiple revenue streams to reduce risk.

- Pay yourself a salary: Transfer a consistent amount monthly for personal expenses.

- Leverage budgeting tools: Use apps like YNAB or spreadsheets to simplify financial planning.

- Use contracts: Protect yourself with clear terms to avoid payment issues.

Takeaway: With these steps, you can smooth out financial ups and downs, allowing you to focus on growing your freelance career.

How To Budget As A Freelancer With Irregular Income

1. Calculate Your Average Monthly Income

The first step to managing your freelance finances is understanding what you truly earn over time. Freelance income can vary wildly - one month might bring in $2,000, while the next could hit $8,000. To create a solid financial plan, you need to calculate your average monthly income.

Here’s how to figure it out: Add up all your earnings from freelance work over the past 6 to 12 months, then divide that total by the number of months. For instance, if your total income over the last year was $45,000, your average monthly income would be $3,750 ($45,000 ÷ 12 months).

A 12-month period is ideal because it reflects seasonal trends and business cycles that can affect your income. For example, Sarah, a freelance graphic designer, noticed her income consistently spiked in January and August but dipped in May and December. Recognizing this pattern allowed her to plan ahead for slower months, avoiding unnecessary stress.

If you’re new to freelancing and don’t have a year’s worth of data, start with at least three months of income records. As you gather more data, update your calculations to refine your average. Lindy Alexander, a full-time freelance writer, tracked her first six months of earnings to establish a baseline average.

Why this is essential: A study found that 68% of freelancers struggle with fluctuating income, which makes budgeting feel like a juggling act. Knowing your average monthly income gives you a stable foundation - it helps you avoid overspending during high-earning months and ensures you’re prepared for leaner times.

"Figuring out your average monthly income is the first step toward stable financial planning and a solid freelancer budget." - The Upwork Team

To keep your financial plan accurate, reassess your income regularly. Consider calculating both an annual average and a rolling 3-6 month average. A rolling average captures recent changes in your earnings while still accounting for long-term trends.

Once you’ve nailed down your average monthly income, you’ll be ready to organize your fixed and variable expenses with confidence.

2. Separate Fixed and Variable Expenses

Once you’ve figured out your average monthly income, the next step is to break down your expenses into two categories: fixed and variable. This helps you see which costs are essential and unchanging, and which ones you have more control over.

Fixed expenses are the ones you can count on being the same each month, no matter what. These include rent or mortgage payments, health insurance, car loans, phone bills, and software subscriptions like Adobe Creative Cloud or QuickBooks. Think of these as your financial constants - they’re predictable, often tied to contracts, and not easily adjusted.

Variable expenses, by contrast, can shift depending on your choices and circumstances. Things like groceries, dining out, entertainment, travel, marketing, and professional development fall into this category. The key here is flexibility - these costs can be scaled up or down based on how much you’re earning.

Some expenses blur the line between fixed and variable. For example, your internet bill might have a flat monthly fee but charge extra if you exceed your data limit. Similarly, some software tools charge a base fee and add usage-based costs.

| Expense Type | Examples | Characteristics |

|---|---|---|

| Fixed | Rent, insurance, car payments, base software subscriptions | Consistent, contractual, same amount monthly |

| Variable | Groceries, dining out, travel, marketing | Adjustable, depends on income and choices |

| Mixed | Phone plans with overage fees, software with usage tiers | Base fee with additional charges |

Organizing your expenses this way makes it easier to adjust when money is tight. For instance, if your fixed costs are $1,800 and your income for the month is $4,000, cutting back on variable expenses can help you stay balanced during slower months.

To get started, review your expenses from the last three months. Write down everything and sort it into the appropriate category. Don’t forget to break annual costs into monthly amounts - if you pay $1,200 a year for professional liability insurance, that’s $100 per month in your fixed expenses. Look for areas to save, like negotiating lower rates when contracts are up for renewal. You might also consolidate software subscriptions - an all-in-one tool for invoicing, time tracking, and accounting could cost less than paying for separate services.

For variable expenses, track your spending patterns over time. This helps you pinpoint where you can cut back during lean months and where you might want to invest more when business is booming.

3. Build an Emergency Fund

As a freelancer, your emergency fund is your financial safety net. Without the perks of traditional employee benefits, having a dedicated fund is critical to weather slow periods and handle unexpected expenses.

How much should you save? Most financial experts recommend saving 3-6 months of living expenses, but freelancers often need a larger cushion due to unpredictable income. Aim for 6-12 months of essential expenses - those unavoidable costs like rent, utilities, groceries, insurance, and minimum debt payments. A LinkedIn poll showed that 51% of respondents agree 6-12 months is ideal for freelancers, while 39% believe 3-6 months is enough.

The reality? Only 25% of Americans have saved enough to cover six months of expenses. For freelancers, this gap can be especially tough, as 38% cite inconsistent earnings as their biggest challenge. An emergency fund helps bridge this gap, offering peace of mind and financial stability. Start small - set an achievable goal and build up gradually.

Here’s how to get started: Begin with $500-$1,000 or save enough to cover one month of essentials. During months when your income is higher, contribute more to your fund. Even small amounts - like $50 during lean months - add up over time. This initial buffer can save you from relying on credit cards when emergencies strike, like a broken laptop or delayed client payments. Once you’ve reached your first goal, work toward a larger fund.

Freelancers need to time their savings efforts wisely. Unlike salaried workers with steady paychecks, your contributions will fluctuate with your income. Take advantage of high-earning months to save more. Even modest contributions during slower periods help build your safety net.

"Savings help you to weather the feast to famine (and back again) cycle that's a common factor of a freelance career", says financial advisor Paul Maplesden. "Stress kills creativity. Savings reduce your money worries and anxiety so you can create awesome content."

To protect your emergency fund, keep it in a separate high-yield savings account, away from your regular checking account. This separation reduces the temptation to dip into it for everyday expenses while still keeping the funds accessible when you truly need them. Mixing emergency savings with business or personal accounts can undermine your financial planning.

A well-funded emergency account gives you the power to say no to low-paying gigs or negotiate better terms without fear. As Sampsa Vainio from Millo.co explains:

"The bigger your fund gets, the more freedom you have to take risks, search for ideal customers, and even take a few months off altogether."

To determine your emergency fund goal, calculate your essential monthly expenses - just the non-negotiables, not your total spending. For example, if your essential expenses are $3,000 per month, your goal should be $18,000-$36,000. While this may seem daunting, remember that this fund replaces the benefits and security of a traditional job.

4. Set Aside Money for Taxes

Managing irregular income as a freelancer means planning not only for expenses and emergencies but also for taxes. Unlike traditional employees who have taxes automatically deducted, freelancers are responsible for covering both federal income taxes and self-employment taxes. These self-employment taxes include contributions to Social Security and Medicare, which are typically split between employers and employees in a standard job.

Tax professionals often suggest setting aside 25-30% of your income for taxes, but the exact amount depends on your tax bracket and deductions. Here’s why this percentage is crucial: self-employment tax alone is 15.3% of your net earnings (12.4% for Social Security and 2.9% for Medicare). Add federal income taxes, and the total can take a significant chunk out of your earnings. For 2025, Social Security tax applies to the first $176,100 of your income, while Medicare tax applies to all earnings. If you earn more than $200,000 (or $250,000 for married couples filing jointly), an additional 0.9% Medicare tax kicks in on the excess.

To make tax payments more manageable, consider opening a separate high-yield savings account specifically for taxes. Each time you receive payment, transfer the tax portion into this account. This approach ensures that the funds are available when you need to pay taxes and prevents accidental spending. Plus, a high-yield account can earn you a little extra interest while the money sits there.

The IRS requires freelancers to pay taxes throughout the year, not just at tax time in April. Quarterly estimated taxes are due on January 15, April 15, June 15, and September 15. If you expect to owe $1,000 or more in federal taxes for the year, you must make these payments to avoid penalties.

"I think it's easier to make 12 smaller payments than four larger payments. If you owe $1,200 for the year, I would rather pay $100 a month than $300 four times a year. And if we're talking bigger numbers, it gets pretty extreme", says Bess Kane, CPA.

To avoid penalties, calculate your payments using the "safe harbor" rule. This means paying at least 90% of what you owe for the current year or 100% of last year’s tax bill (or 110% if your adjusted gross income exceeded $150,000). This method provides some protection if your income unexpectedly increases.

Be cautious about overpaying. While it may feel safer, any excess goes to the IRS as an interest-free loan, which doesn’t benefit you.

Throughout the year, track your income and expenses carefully. Deductible business expenses - like equipment, software, professional development, and even part of your home office - can lower your taxable income. If your income varies significantly, adjust your quarterly estimates using Form 1040-ES to avoid overpaying or underpaying.

Finally, set up electronic payments through the IRS website. This method avoids processing fees and ensures payments are on time. Late payments can result in penalties starting at 0.5% of your tax liability per month, maxing out at 25% - a steep price for missed deadlines that can easily be avoided with proper planning.

5. Create Two Budgets: Lean and High-Income Months

Freelancers often experience unpredictable income, with some months bringing in a surplus while others barely cover the basics. To navigate this, creating two budgets - one for lean months and another for high-income months - can help you manage your finances more effectively.

Your lean budget should focus solely on essential expenses. This includes rent, utilities, minimum debt payments, groceries, transportation, health insurance, and tax savings. For instance, if your essential monthly costs add up to $4,200, your lean budget shouldn’t exceed that amount.

On the other hand, your high-income budget builds on your lean budget by adding discretionary expenses. These might include professional development courses, new equipment, higher-quality groceries, entertainment, travel, or extra retirement contributions. For example, if you earn $12,000 in a good month, you might allocate $4,200 for essentials, $3,600 for taxes (30%), $2,000 for your emergency fund, and $2,200 for discretionary spending and investments.

To make this system work, set clear income thresholds to determine which budget to use. If your average income is $7,500, you might stick to your lean budget when earnings fall below $5,000 and switch to your high-income budget when they exceed $9,000. For months in between, you can use a modified version of your lean budget with a few selective additions.

Track your income patterns to fine-tune these thresholds. Many freelancers notice seasonal trends in their work. For example, graphic designers might see a spike in projects during the holiday season, while tax consultants are busiest from January to April. Recognizing these patterns allows you to better prepare for slower months.

When applying this dual-budget system, wait until income is actually in your account before spending. Freelancers often make the mistake of spending based on expected payments, only to find themselves short when a client delays payment or cancels a project.

To stay disciplined, consider using separate bank accounts. Keep your lean budget funds in one account and your discretionary funds in another. This separation makes it easier to stick to your essentials-only budget during tighter months and avoid overspending when income is high.

Finally, as your freelance business grows, revisit and adjust your budgets regularly. For example, if your lean budget threshold starts at $5,000, it may need to increase to $7,500 as your business expands and your expenses rise. Reviewing your budgets quarterly ensures they stay relevant to your evolving financial situation.

6. Track Income and Expenses Regularly

Keeping a close eye on your income and expenses is a cornerstone of effective freelance budgeting. Without regular monitoring, even the best-laid financial plans can fall apart. Many freelancers only check their finances when something goes wrong, but consistent tracking can stop small issues from spiraling into big problems.

A weekly check-in is one of the easiest ways to stay on top of things. Set aside 15 minutes every Friday to review your income, categorize your expenses, and update your records. This small habit can save you from the headache of sorting through months of transactions when tax season rolls around. Use this time to see how your spending aligns with your budget and make any necessary adjustments.

For convenience, apps like Mint, YNAB (You Need A Budget), and QuickBooks Self-Employed can automatically categorize your transactions and sync with your bank accounts. If you prefer a hands-on approach, a simple spreadsheet can do the trick. Set up columns for the date, description, category, income, and expenses, and update it after each transaction. This real-time tracking keeps you informed and helps you make smarter financial decisions as you go.

To avoid missing expenses, set reminders to log every transaction immediately. Whether it’s a coffee run, parking fee, or office supply purchase, recording it on the spot ensures your records are accurate. Small, forgotten expenses can add up quickly, so staying on top of them is key.

At the end of each month, take a moment to compare your expense tracker with your bank and credit card statements. This step not only ensures accuracy but also helps you spot any fraudulent charges or subscriptions you no longer use. Many freelancers are surprised to find they’re still paying for services they thought they had canceled. This monthly review is a great way to clean up your finances and stay organized.

Freelancers who track their finances regularly often feel more confident about money management. They know exactly where they stand and can easily answer questions like, "Can I afford this new equipment?" or "How much should I save for taxes this quarter?" Having up-to-date data at your fingertips makes decision-making less stressful and more informed.

Finally, document every expense carefully, including mixed-use items like your phone bill or home internet if they’re partially used for work. Accurate records not only simplify tax preparation but also ensure you’re making the most of your deductions. By staying consistent, you’ll build a strong foundation for managing your freelance finances.

7. Diversify Income Streams

Relying on just one client can leave you vulnerable to sudden income gaps if a contract ends unexpectedly. A diversified income strategy not only cushions you against these financial shocks but also opens up opportunities for steady growth over time.

The idea is to create income sources that grow without requiring constant effort. For instance, one freelancer shared that 20% of their annual earnings now come from multiple revenue streams, providing peace of mind during slower months. This approach ties directly into a smarter, more resilient budgeting plan.

Diversifying your income doesn’t just stabilize cash flow; it also strengthens the financial strategies you’ve already put in place.

One popular option is creating online courses. If you’re a graphic designer, you could teach logo design. If you’re a web developer, a course on programming languages could be your niche. After the initial work of building the course, it can generate passive income with little ongoing effort. Platforms like Udemy, Teachable, and Skillshare make it easy to reach audiences worldwide.

Digital products are another great avenue. Think about writing an ebook, designing templates, or developing software tools that solve common problems in your industry. These products involve low upfront costs and can be sold repeatedly with no additional production expenses - making them a smart long-term investment.

Offering consulting services is another way to leverage your expertise. Consulting often pays higher hourly rates than standard freelance work, and it can lead to retainer agreements that provide consistent monthly income.

If you’ve built an audience, affiliate marketing can also be a lucrative option. By recommending products or services that align with your niche, you can earn commissions on sales. The more trust you build with your audience, the more this revenue stream can grow.

Licensing your work is another way to earn recurring income while retaining ownership. For example, photographers can sell stock images, writers can license their articles to various publications, and developers can license their code libraries. This approach expands your reach without requiring additional effort.

Transforming one-off projects into monthly retainers can also provide a steady income. This arrangement reduces the constant need to chase new clients and offers financial predictability.

Finally, consider flexible part-time roles that complement your freelance skills. These roles can provide a dependable income stream while leaving you enough time to focus on your freelance projects.

8. Pay Yourself a Set Salary

One of the best ways to bring stability to your finances as a freelancer is to pay yourself a consistent monthly salary. By doing this, you turn the unpredictable nature of freelance income into a steady paycheck, making it easier to budget and plan for your personal expenses.

Here’s how it works: you decide on a fixed amount to transfer from your business account to your personal account on the same date every month. During months when your income is higher, the extra money stays in your business account, creating a buffer. In slower months, you can use that buffer to maintain your regular salary payments.

To get started, calculate your baseline salary. Look at your average monthly expenses over the past six to twelve months. Include essentials like rent, utilities, groceries, insurance, and transportation, and add a little extra for discretionary spending. For example, if your expenses average $4,200 per month, you might set your salary at $4,500 to give yourself a cushion.

Pick a consistent payday, like the first or fifteenth of the month, and stick to it. Automating the transfer from your business account to your personal account can help make this process seamless and ensure you stay consistent.

This method helps prevent overspending during high-earning months and reduces stress during slower periods. Instead of seeing a large balance in your business account and splurging on unnecessary expenses, you’ll stay disciplined and focused on your set salary. And when work slows down, you won’t be scrambling to cover essentials like rent or groceries because your income remains steady. This gives you the freedom to focus on finding new opportunities without the immediate pressure of financial strain.

Over time, the leftover funds in your business account will build up, creating a reserve that can cover several months of salary during leaner times. Some freelancers choose to review and adjust their salary every quarter as their income grows. For instance, if your average income rises significantly over three months, you might decide to increase your salary slightly during your next review.

9. Use Budgeting Tools and Apps

Budgeting tools and apps can be game-changers for freelancers dealing with fluctuating income. They simplify the process of tracking income and expenses, ensuring every dollar has a purpose. Instead of manually updating spreadsheets whenever money moves in or out, these apps sync with your bank accounts and credit cards to provide real-time updates on your financial standing.

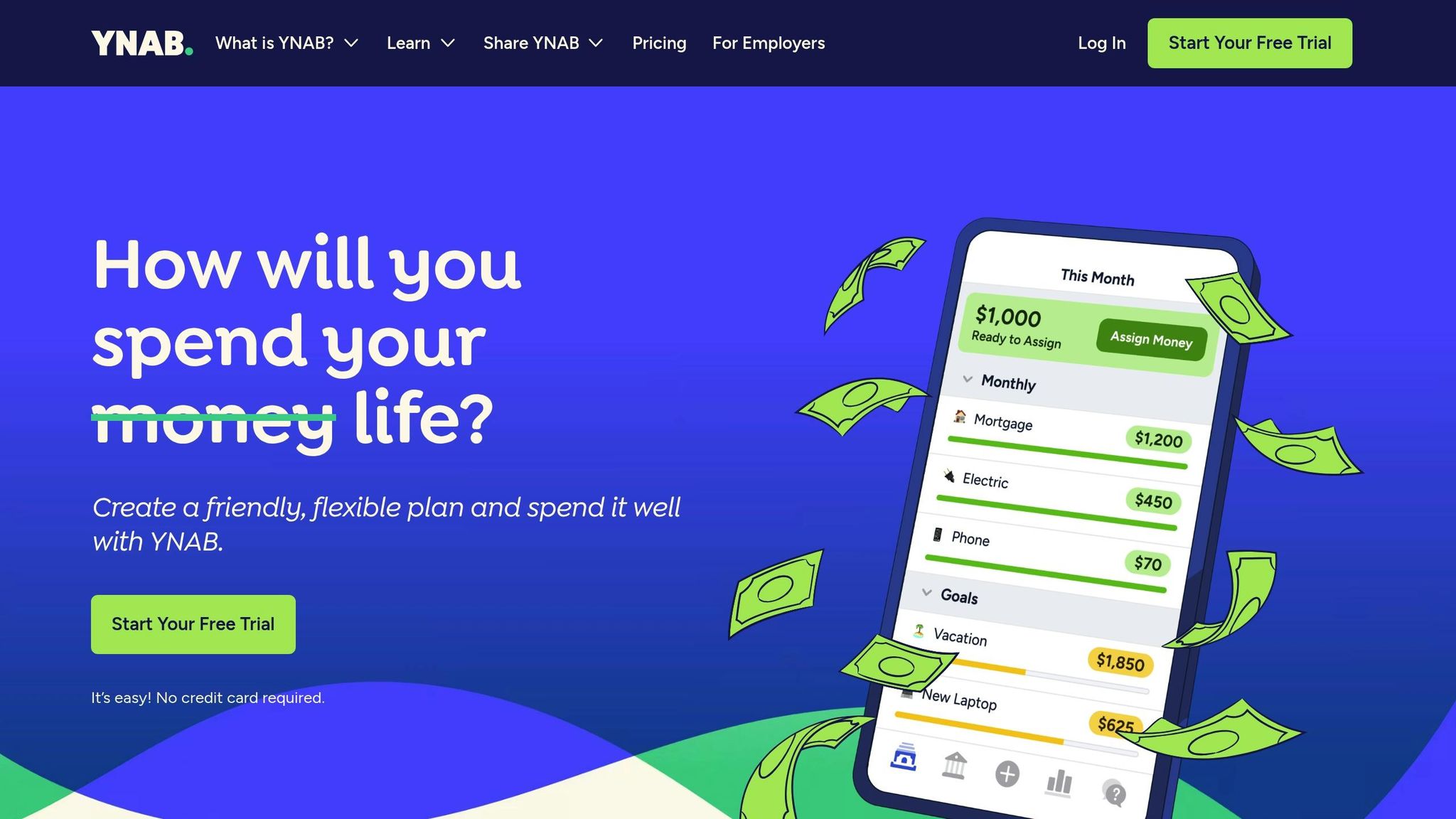

For freelancers, YNAB (You Need A Budget) is a standout option. It focuses on the money you actually have, not what you expect to earn, making it ideal for irregular income. Using a zero-based budgeting approach, YNAB lets you allocate every dollar to a specific purpose and adjust plans as your income changes.

Another popular choice is Mint, which not only tracks your spending but also helps you budget for irregular expenses. It automatically categorizes transactions and offers its budgeting features for free. If you prefer a more hands-on approach, Google Sheets allows you to create fully customizable spreadsheets tailored to your unique financial needs.

These tools are particularly helpful for planning ahead for irregular or non-monthly expenses. For instance, instead of scrambling to pay a $1,200 annual insurance premium, you can set aside $100 each month to make sure the money is ready when the bill comes due. This proactive approach helps prevent financial surprises from derailing your budget.

Budgeting apps also reduce the hassle of manual data entry and minimize errors, all while keeping you informed about your cash flow. Many apps come with features like goal setting, spending analysis, and comprehensive financial planning tools, giving you a clearer picture of your finances.

"Personal finance apps offer features like automatic transaction syncing, real-time updates, and spending analysis, which streamline budgeting and tracking compared to manual Excel spreadsheets. Apps also provide insights and alerts, helping you manage finances with less effort and more accuracy." – TwoPeas Team

10. Protect Yourself with Contracts

Contracts are your safety net as a freelancer - they guard against late payments, scope creep, and clients who might try to dodge paying altogether. A strong contract turns a casual handshake into a formal agreement, ensuring your income is protected while setting clear expectations for both parties.

To safeguard your earnings, include specific terms in every contract. For instance, spell out payment timelines like net-15 or net-30 terms and add late payment fees - typically around 1.5% to 2% per month - to discourage delays. Many freelancers also require a 50% upfront deposit for new clients or projects over $1,000. This upfront payment not only improves cash flow but also reduces the risk of non-payment.

Be crystal clear about the scope of the project and what counts as extra work. Let’s say you’re a graphic designer working on a logo package - define exactly how many initial designs you’ll deliver, the number of revision rounds included, and your hourly rate for anything beyond the agreed scope. This clarity avoids misunderstandings and keeps the project on track.

Another important clause to include is a kill fee. This protects you if a client cancels midway through a project by guaranteeing payment for a percentage of the total fee - usually between 25% and 50% - plus compensation for work already completed. It’s a simple way to keep your finances steady, even when plans change unexpectedly.

If you’re unsure where to start, platforms like LawDepot and PandaDoc offer contract templates tailored for freelancers. These include standard clauses that safeguard your interests while being legally enforceable. For big-ticket projects worth over $5,000, consider having a lawyer review your contract - it’s an upfront cost that can save you from costly disputes down the road.

But having a contract is only half the battle - you need to enforce it. Send invoices promptly when milestones are completed, and follow up on overdue payments to apply any late fees. Consistently enforcing your terms trains clients to respect your payment schedule and ensures a steady cash flow. Think of it like budgeting: staying proactive is key to keeping your freelance finances healthy.

Comparison Table

Managing your finances on an irregular income can feel like a juggling act. Picking the right budgeting tool can make all the difference in staying organized and prepared for both high and low-earning months. Below is a comparison of popular budgeting tools to help you find the one that works best for your unique income patterns.

| Feature | YNAB (You Need A Budget) | Spreadsheets (Excel/Google Sheets) | Mint (Discontinued) |

|---|---|---|---|

| Monthly Cost | $14.99/month or $109/year ($9.08/month) | Free (Google Sheets) or ~$7/month (Excel 365) | Free (shut down Oct 31, 2023) |

| Best For | Hands-on budgeters who want control | DIY enthusiasts who love customization | N/A - users moved to Credit Karma |

| Irregular Income Support | Excellent - built for variable income | Perfect - fully customizable | Limited - traditional budgeting only |

| Learning Curve | Moderate - requires understanding zero-based budgeting | High - need to build from scratch | Easy - automatic setup |

| Automation Level | Semi-automatic with manual allocation | Fully manual | Highly automated |

| Tax Planning Features | Basic category tracking | Advanced - custom tax calculators | None |

| Emergency Fund Tracking | Built-in goal setting | Custom formulas and tracking | Basic savings goals |

Why Choose YNAB?

YNAB stands out for freelancers and gig workers because it uses zero-based budgeting, which forces you to assign every dollar a purpose - whether that's rent, savings, or taxes. This approach is particularly useful when your income fluctuates wildly, like earning $2,000 one month and $8,000 the next. During high-earning months, you can allocate funds to cover expenses during leaner times. Plus, YNAB offers a 34-day free trial, making it a low-risk option to try out.

Are Spreadsheets a Better Fit?

If you love diving deep into customization, spreadsheets might be your go-to. They’re perfect for freelancers with complex financial needs. You can create separate tabs for different income streams, build tax calculators for quarterly payments, and even design templates for "lean months" versus "high-income months." Google Sheets is free and syncs effortlessly across devices, while Excel offers powerful tools like pivot tables to analyze your income trends over time.

Spreadsheets give you full control, but they require more effort upfront. If you’re comfortable working with formulas and want a tailored solution, this option provides unmatched flexibility at minimal cost.

What Happened to Mint?

Mint was discontinued in October 2023. While it was free and user-friendly, it relied on traditional budgeting methods that didn’t suit freelancers with inconsistent earnings. Many Mint users transitioned to Credit Karma, but that platform focuses more on credit monitoring than on detailed budgeting.

Which Tool Should You Pick?

For most freelancers, YNAB offers the right mix of structure and adaptability without needing advanced technical skills. On the other hand, if you’re confident with spreadsheets and crave complete control, they’re a budget-friendly and powerful alternative. Ultimately, the best tool is the one you’ll stick with - whether your monthly income is $1,500 or $15,000.

Conclusion

Handling irregular income as a freelancer isn’t just possible - it’s manageable with the right approach. The ten strategies we’ve discussed - from calculating your average monthly earnings to safeguarding yourself with clear contracts - lay the groundwork for navigating both high and low-income periods with confidence.

By making these budgeting practices part of your routine, you can take charge of the ups and downs of freelancing. Prioritize separating fixed expenses from variable ones, commit to building an emergency fund (even if it’s just $25 a week), and always set aside money for taxes before you’re tempted to spend it. These habits are practical whether you’re bringing in $2,000 or $10,000 in a month.

Diversifying your income streams and paying yourself a steady salary are key to long-term stability. When you have multiple clients or projects contributing to your income, losing one won’t feel like the end of the world. And don’t underestimate the importance of choosing a budgeting tool that works for you - whether it’s YNAB’s zero-based system or a custom spreadsheet, pick something you’ll actually use consistently.

The key is to start small and stay consistent. Maybe that means opening a dedicated tax savings account or drafting stronger client contracts with clear payment terms. Small, steady actions create the foundation for turning freelancing into a sustainable and rewarding career.

With thoughtful planning and the right tools, freelancing can offer you both freedom and financial stability. It’s all about building a system that supports your goals while giving you peace of mind about your financial future.

FAQs

How much should I save for an emergency fund as a freelancer with irregular income?

To create a reliable emergency fund as a freelancer, try to save enough to cover 3 to 6 months of essential expenses. If your income tends to fluctuate significantly, aim for the higher end - or even more - so you're better prepared for slower months.

When you have a particularly strong earning month, use that opportunity to set aside extra funds. Regularly check in on your savings and adjust as your income or expenses shift over time. Having this financial cushion can help you weather unpredictable periods and provide a sense of stability while managing the ups and downs of freelance life.

How can I effectively manage tax payments with fluctuating freelance income?

Managing taxes when you're dealing with irregular freelance income can feel like a puzzle, but there are practical ways to stay on top of it. One key step is to make quarterly estimated tax payments. These payments, based on your projected income, can help you avoid penalties and interest down the line.

It's also smart to keep your personal and business finances separate. This makes tracking deductible expenses much easier and can reduce your taxable income. Plus, having a clear financial picture simplifies everything when tax season rolls around.

Another helpful tip? Build an emergency fund. Freelance income can be unpredictable, so having money set aside for tax payments during slower months can save you a lot of stress. Pair this with conservative budgeting to ensure you're ready for any unexpected expenses.

Finally, stay organized. Keeping detailed records of your income and expenses throughout the year will make filing taxes smoother and more accurate. And if you're unsure about anything, don’t hesitate to consult a tax professional - they can help ensure you're following the rules and getting the deductions you're entitled to.

How can I effectively switch between lean and high-income budgets to stay financially stable as a freelancer?

To manage your finances effectively with an irregular income, start by crafting two separate budgets: a lean budget for your baseline, or minimum expected income, and a high-income budget for those months when you earn more. Keeping a close eye on your income and expenses will help you know when to switch between these budgets.

In months when your income is lower, stick to the lean budget to ensure you cover only the essentials and avoid unnecessary spending. When your income is higher, use the extra cash wisely - put it toward savings, paying off debt, or building an emergency fund. This approach not only keeps your finances steady but also helps you prepare for any ups and downs in the future.